sales tax oklahoma tulsa ok

Tulsa OK Sales Tax Rate. 7288 tulsa cty 0367 7388 wagoner cty 130 7488 washington cty 1.

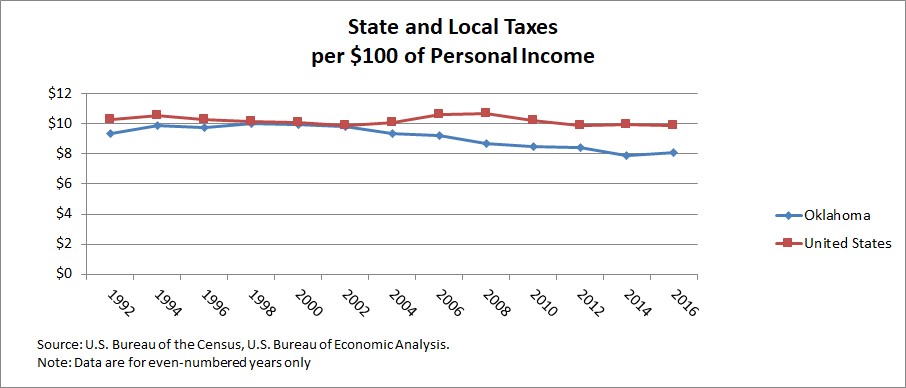

Oklahoma Tax History Oklahoma Policy Institute

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. 608 rows 2022 List of Oklahoma Local Sales Tax Rates.

The 2018 United States Supreme Court decision in South Dakota v. The latest sales tax rate for Tulsa OK. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. Sales Use Compliance Experienced Associate.

SOLD MAR 22 2022. The Tulsa County Treasurers Office holds a real estate auction each year on the second Monday of June and continues from day to day thereafter until said sale has been completed. 6th St 8th Floor.

State of Oklahoma - 45. 2 to general fund. The cost for the first 1500 dollars is a flat 20 dollar fee.

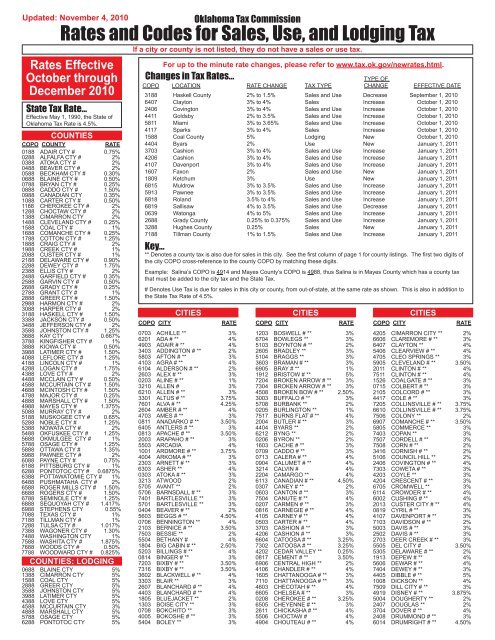

The City has five major tax categories and collectively they provide 52 of the projected revenue. 5513 Luther 3 to 4 Sales and Use Increase October 1 2021 0114 Stillwell 35 to 375 Sales and Use Increase October 1 2021 3388 Jackson County 0625 to 1125 Sales and Use Increase October 1 2021 5988 Pawnee County 2 to 125 Sales and Use Decrease October 1 2021. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but.

This is the total of state and county sales tax rates. The make model and year of your vehicle. The 2018 United States Supreme Court decision in South Dakota v.

Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Sales tax at 365.

The Oklahoma sales tax rate is currently. Sale Location Map - for the designated sale. US Sales Tax Rates OK Rates Sales Tax Calculator Sales Tax Table.

16326 E Oklahoma St Tulsa OK 74116 210000 MLS 2217688 Well-maintained home in quiet established neighborhood. Job in Tulsa - Tulsa County - OK Oklahoma - USA 74145. This is the total of state county and city sales tax rates.

Tulsa County - 0367. 190000 Last Sold Price. 2020 rates included for use while preparing your income tax deduction.

The Tulsa Sales Tax is collected by the merchant on. Nearby homes similar to 3012 N Tulsa Dr have recently sold between 125K to 295K at an average of 110 per square foot. The County sales tax rate is.

Wayfair Inc affect Oklahoma. The Tulsa sales tax rate is. The Tulsa County Sales Tax is collected by the merchant on all qualifying sales made within Tulsa County.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. 11 to capital fund. For tax rates in other cities see Oklahoma sales taxes by city and county.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. This rate includes any state county city and local sales taxes. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

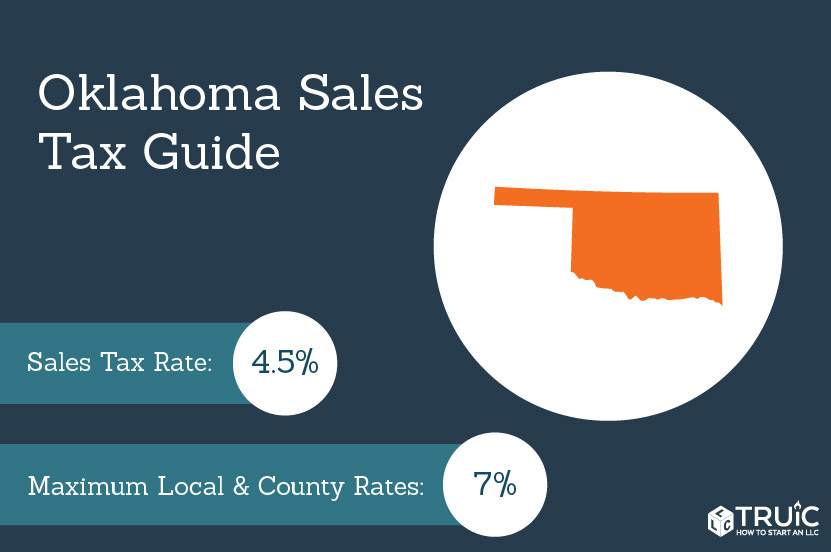

Denotes a county tax is also due for sales in this city. The state of oklahoma tax rate is 45. Oklahoma has a lower state sales tax than 885.

7288 tulsa cty 0367 7388 wagoner cty 130 7488 6610 washington cty 0409 1. Heres how Tulsa Countys maximum sales tax rate of 10633 compares to other counties around the. Tulsa County has a lower sales tax than 981 of.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. 5003 davis 3 2502 davis 2703 deer creek 3 5505 del city 450 5305 delaware 2 1913 depew 4.

Fast Easy Tax Solutions. The use tax essentially serves as a sales tax on imports to Oklahoma. Yukon OK Sales Tax Rate.

City salesuse tax copo city rate copo city rate city salesuse tax. Ad Find Out Sales Tax Rates For Free. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax.

Average Sales Tax With Local. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

3021 N Roff Ave Oklahoma City OK 73107. In addition to taxes car purchases in. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

31 rows The latest sales tax rates for cities in Oklahoma OK state. Did South Dakota v. New 20000 or less.

Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. Tulsa collects a 0 local. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Has impacted many state nexus laws and sales tax. There is no applicable special tax. The current total local sales tax rate in Tulsa County OK is 4867.

0819 cyril 4 4107 davenport 4 7103 davidson 4 5003 davis 3 2502 davis 3 2703 deer creek 3 5505 del city 450. The Oklahoma state sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction.

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax. Effective may 1 1990 the state of oklahoma tax rate is 45. 2483 lower than the maximum sales tax in OK.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Tulsa County sales tax rate is. Stillwater OK Sales Tax Rate.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Country living with city ameniti. An example of an item that exempt from Oklahoma is prescription medication.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. You can print a 8517 sales tax table here. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

For specific purposes such as public safety major capital investments or jails. Tax Preparer Tax Analyst. 2483 lower than the maximum sales tax in OK.

It is charged when items are bought out of state but brought in for use in. In addition to taxes car purchases in Oklahoma may be subject to other fees like. City salesuse tax copo city rate copo city rate city salesuse tax.

3 beds 2 baths 1636 sq. Rates include state county and city taxes.

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

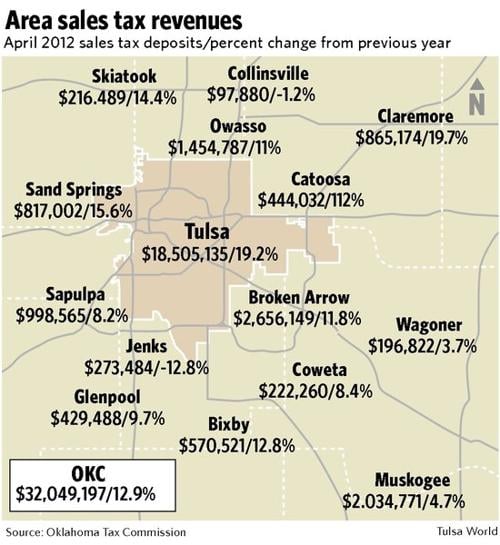

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

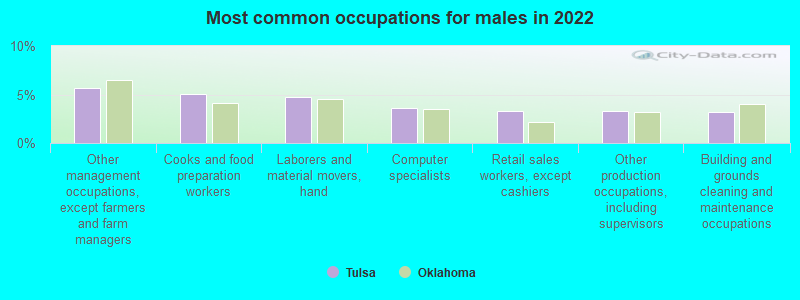

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Tax Forms Tax Information Tulsa Library

Taxes Broken Arrow Ok Economic Development

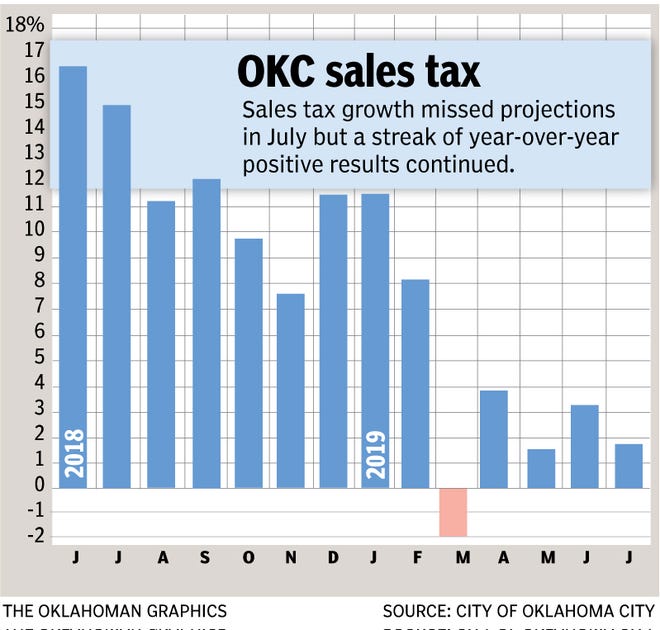

July Sales Tax Revenue Up But Misses Monthly Target In Oklahoma City

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Total Sales Tax Per Dollar By City Oklahoma Watch

Oklahoma S Tax Mix Oklahoma Policy Institute

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute