how to lower property taxes in maryland

THE ASSESSMENT PROCESS FAIR MARKET VALUE. Ad Apply For Tax Forgiveness and get help through the process.

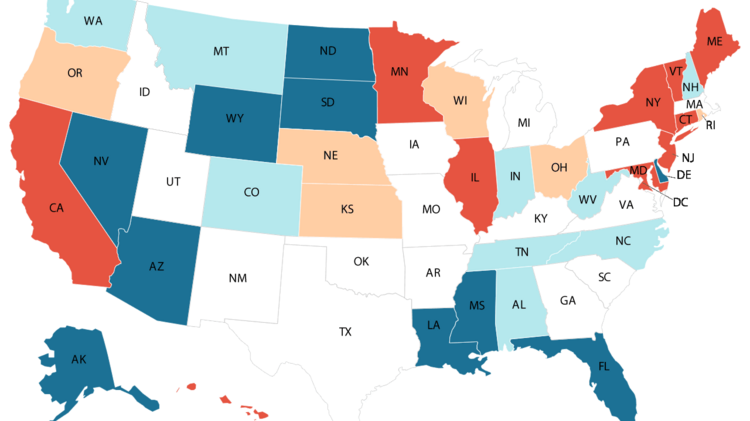

State Corporate Income Tax Rates And Brackets Tax Foundation

The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland.

. If your neighbors house were valued at less than 250000 they would not be. The 2021 standard deduction allows taxpayers to reduce their taxable income by up to 2350 for single filers and up to. The tax levies are based on property assessments determined by the Maryland Department of Assessments and.

Armed Services veterans with a permanent and total service connected disability rated 100 by the Veterans Administration may receive a complete exemption from real property taxes on the dwelling house and surrounding yard. State Property Tax Exemption Benefits. Tax rates are set by the County Council each fiscal year.

The average effective tax rate in Baltimore County is 117. Tax amount varies by county. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

A Personal Property Lien Certificate is available for 55. How Is Income Defined. The state of Maryland offers a standard and itemized deduction for taxpayers.

While the state government handles property assessments in Maryland local governments still set their own tax rates. Get a copy of your property tax card from the local assessors office. 1 day ago Up to 25 cash back How to Stop a Property Tax Sale in Maryland If you want to stop a Maryland property tax sale from happening you must pay the overdue amounts.

If the tax rate was 104 per 100 of assessed value the tax credit would be 104 10000 100 x 104. First the term gross income means gross revenues derived from the agricultural activity only. The deadline to apply is Sept.

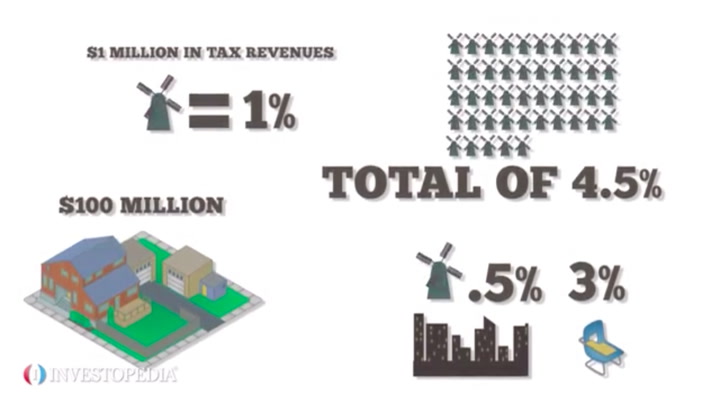

Ad Based On Circumstances You May Already Qualify For Tax Relief. For more information please call 410-996-2760 or email at sdatperspropmarylandgov. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

As is the case with most states Maryland property taxes are primarily a local revenue. Property tax bills are typically. 087 of home value.

If you have questions please contact Taxpayer Services at financeinfobaltimorecountymdgov or call 410-887-2404. Taxes are calculated by dividing the taxable assessment by 100 and then multiplying by the tax rate. 8 ways to lower your property taxes and get some money back Review your property tax card.

100000 divided by 100 times 108 which equals 108000. The credit is called a circuit breaker because it turns off the property tax for low-income homeowners just like an electrical circuit breaker turns off power. In other words it sets a limit on the amount of property taxes any homeowner must pay based upon his or her income.

Using an effective tax rate of 108 per 100 for this example 100 local property tax plus 08 state property tax the amount of property taxes due would be calculated like this. For Jones the circuit breaker means she pays 500 in property taxes each year 1300 less than the full bill. The tax credit would apply to the taxes due on the 10000.

Counties in Maryland collect an average of 087 of a propertys assesed fair market value as property tax per year. Again youll get 30 days notice that the property will be sold if the arrears interest and penalties arent paid. The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000.

Homeowners can seek a tax credit if their property tax bill exceeds a certain percentage of their annual gross income which must be below 60000. This detailed report tells you everything you need to know about reduc. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

This detailed report tells you everything you need to know about reduc. Credits Brownfields Commercial Revitalization Conservation Land. Tax Credits and Tax Relief Programs Learn more about each tax credit or tax relief program below.

Property Tax Exemption- Disabled Veterans and Surviving Spouses. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Maryland Property Tax Rates.

So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be 80000. So if your property is assessed at 300000 and. The rates are based on 100 of assessed value taxable assessment.

Office of Budget and Finance. The full sliding scale can be found here. For more information on Personal Property Tax Clearance Certificates call 410-887-2411.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the persons gross income. Read customer reviews find best sellers. Should the Department elect to apply the 2500 gross income test it is important that the property owner understand what is required.

Send a check made payable to Baltimore County Maryland to. Ad Find Recommended Maryland Tax Accountants Fast Free on Bark. Browse discover thousands of brands.

Large increases in your assessments are applied in phases that are limited to a maximum of 10 each year. 400 Washington Avenue Room 150. Downloadable applications are available for most credits and programs.

14-812 Notice After a Maryland Property Tax Sale. Tax rates in the county are roughly equal to the state average but are significantly lower than those in the city of Baltimore.

Property Tax Comparison By State For Cross State Businesses

Your Guide To Maryland Real Estate Taxes Upnest

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

About Renew Baltimore Renew Baltimore

Maryland Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2022 Free Investor Guide

Property Taxes By State County Lowest Property Taxes In The Us Mapped

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

Maryland Property Tax Calculator Smartasset

Maryland Business Personal Property Tax A Guide

Maryland Estate Tax Everything You Need To Know Smartasset

How Property Taxes Are Calculated

Deducting Property Taxes H R Block

Maryland Business Personal Property Tax A Guide

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey